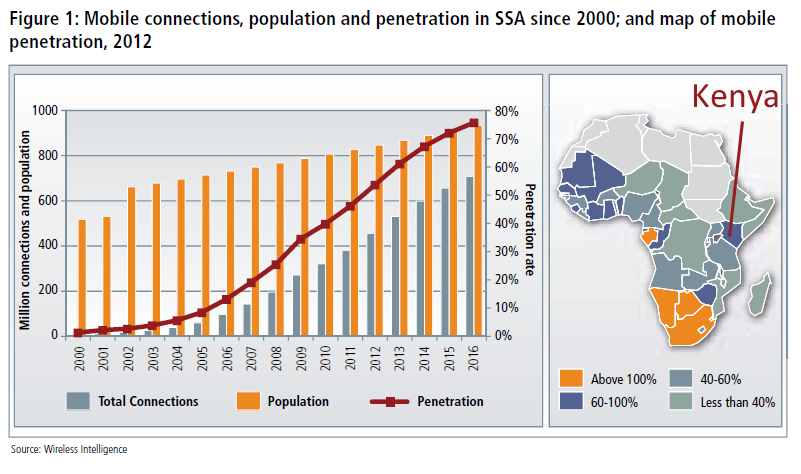

Market Size: $1.2 Billion per Day

The gross annual product of Kenya's mobile payments system is currently $23 billion, and still growing. SunScore's value is in accurately determining the risk-profile of people currently outside the traditional banking sector. Financial industries typically bring in around 5-7% of GDP. If we captured only 1% of mobile transactions, there is a potential revenue stream $2.3 billion annually.

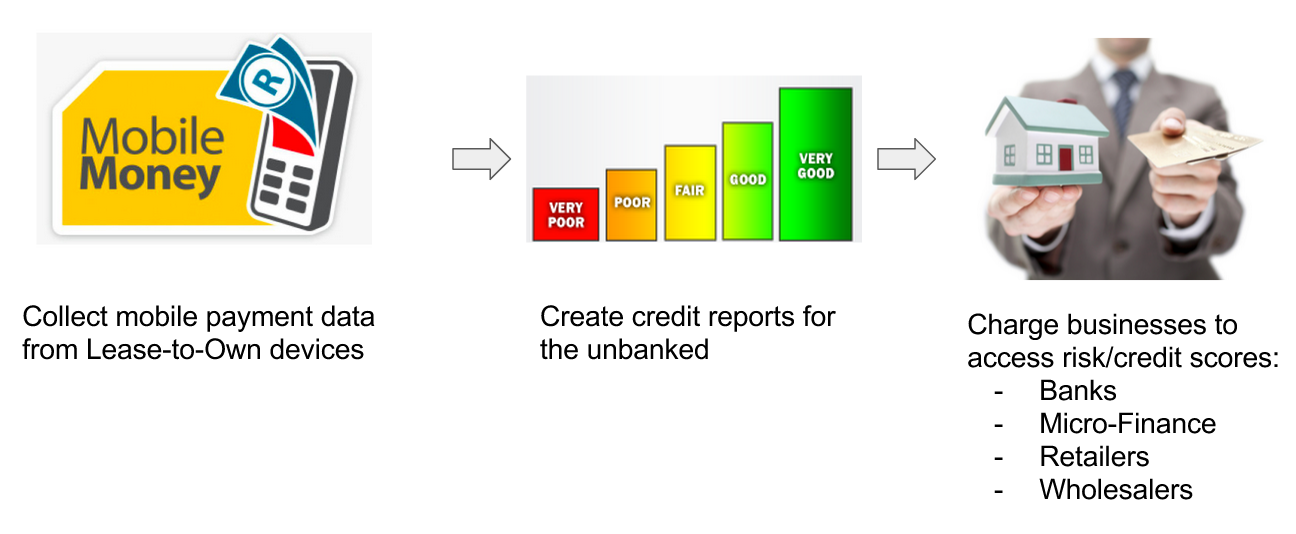

Business Model

Parterning with solar companies, we collect payback data to generate credit histories and credit scores. These histories and scores can be sold to financial institutions to provide targetted loans.

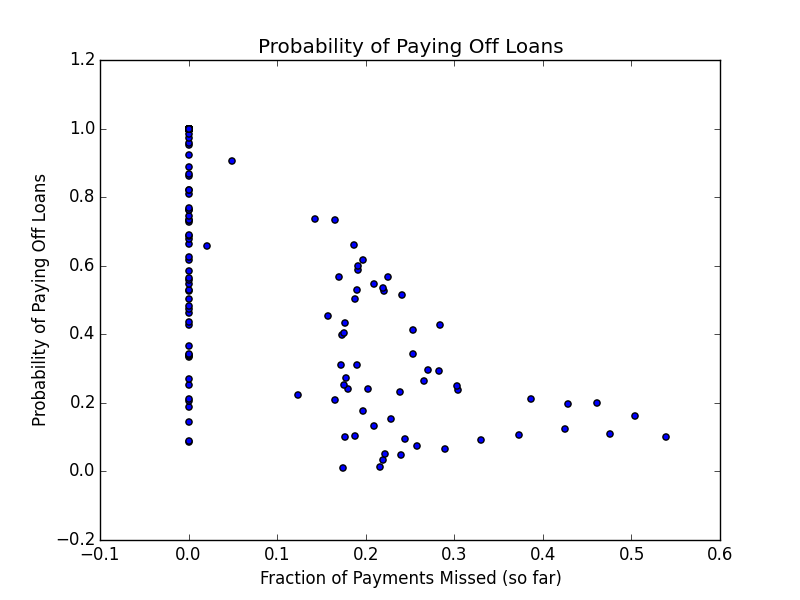

Simulated Data

We gathered data from organizations such as the IMF and World Bank on Mortality, Economics, and Weather patterns in Kenya to build a stochastic model. Using this simulated data, we generated distributions of probabilities of paying back loans.

Predictive Modelling

As our datasets grow, we anticipate becoming a layer of a person's mobile payment infrastructure, providing them access to credit in exchange for their purchase data a la Visa. Leveraging buying patterns and Big Data we will be able to erase information asymmetry by better estimating risk.

Disruptive Strategy

Fraud Prevention

M-Pesa has never been Hacked. Each number is essentially a social security number and cannot be transferred between providers. If one want a new identity, they need to open up a new line of credit. In addition, our team has expertise in fraud detection, so as examples of fraud are detected, we are prepared to put necessary blocks in place.